Learn about the latest News & Events for Finance New Orleans, and sign up to receive news updates.

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Learn about the latest News & Events for Finance New Orleans, and sign up to receive news updates.

Upcoming Events

No upcoming events. Add this issuer to your watchlist to get alerts about important updates.News & Press Releases

The Walton Family Foundation has awarded $775,000 to a strategic partnership between Quantified Ventures (QV) and PRE Collective (PRE) to accelerate investments in nature-based climate and water solutions in the Colorado River and Mississippi River Basins.

The partnership will provide grants and technical assistance to three Green Banks – the Illinois Finance Authority, Finance New Orleans, and the Colorado Clean Energy Fund – to build a pipeline of scalable nature-based projects with measurable greenhouse gas reduction benefits, including sustainable agriculture, green stormwater infrastructure, and watershed restoration.

This award follows the efforts of the U.S. Environmental Protection Agency’s Greenhouse Gas Reduction Fund (GGRF) to capitalize green banks across the country, representing a once-in-a generation opportunity to shift financing interest toward nature-based climate mitigation efforts. In April 2024, the Robert Wood Johnson Foundation committed $1.3 million to support QV, PRE, and partners in similar work in different regions of the United States.

Financing and funding for environmental infrastructure and nature-based climate solutions is critical at this juncture. A recent Request for Information from QV resulted in 120+ projects in the pipeline across the country, with nearly $4.5 Billion in project financing needed.

Partner Quotes:

Tee Thomas, CEO, Quantified Ventures: “Green Banks are force multipliers for solutions at the intersection of climate, nature, and community resilience. Thanks to the Walton Family Foundation, this funding and technical assistance will better equip three leading Green Banks to identify, evaluate, catalyze, and scale impactful nature-based projects across two critical Watersheds.”

Shalini Vajjhala, Executive Director, PRE Collective: “Nature-based infrastructure projects are both the most exciting and challenging projects to design and finance. The Walton Family Foundation’s investment in early-stage predevelopment with Green Banks is a transformational opportunity to demonstrate how multi-benefit, community-centered, landscape-scale solutions can be part of a comprehensive portfolio of climate investments.”

Chris Meister, Executive Director, Illinois Finance Authority: “The Illinois Finance Authority/Climate Bank is grateful to the Walton Family Foundation for its inclusion of Green Banks in this strategic effort. Building on a record of past climate finance innovation, the Authority looks forward to partnering with Qualified Ventures and PRE Collective to build new financial products for nature-based infrastructure projects. Nature-based solutions offer innovative and impactful ways to address climate challenges outside of traditional renewable energy products.”

Annie Clark, Chief Programs Officer, Finance New Orleans: “We are grateful to be a recipient of the Walton Family Foundation’s investment in nature-based solutions. This funding is a significant step forward in our mission to build resilient communities through sustainable investments. By focusing on nature-based solutions, we are not only addressing the immediate impacts of climate change but also laying the groundwork for long-term environmental and economic benefits. The support from the Walton Family Foundation will empower us to expand our efforts in New Orleans, and we are committed to driving measurable change that will benefit future generations.”

Paul Scharfenberger, CEO, Colorado Clean Energy Fund: “Walton Family Foundation’s investment and support, combined with technical assistance from QV and PRE, will enable CCEF and other Green Banks to expand our investment focus areas and capacity to include nature-based projects that are critical to combating climate change. CCEF is grateful for the partnership, and we value the innovative thinking of all the organizations involved.”

Morgan Snyder, Senior Program Officer, Walton Family Foundation: “We must make more low cost financing available, like those in the GGRF, to scale natural climate solutions to adapt to the impacts of climate change on our water systems. We are proud to partner with QV and PRE to lead this effort.”

About PRE Collective

PRE Collective is a group of public-service minded infrastructure and project development experts helping communities and regions make the most of transformational infrastructure opportunities. We focus on pre development – the early, messy space where infrastructure gaps, needs, priorities, and potential solutions are framed. Our goal is to build collective momentum for equitable implementation of climate mitigation and adaptation solutions.

About Quantified Ventures

Quantified Ventures (QV) is a nationally recognized leader in implementing innovative funding and financing strategies for climate, environmental, health, and human services projects. Our success stems from quantifying project outcomes, identifying untapped financial resources, and structuring innovative partnerships that engage new capital providers and stakeholders. QV is a certified B Corporation and WBENC women-owned business that has worked extensively to provide technical assistance for establishing and administering water, energy, and climate financing programs.

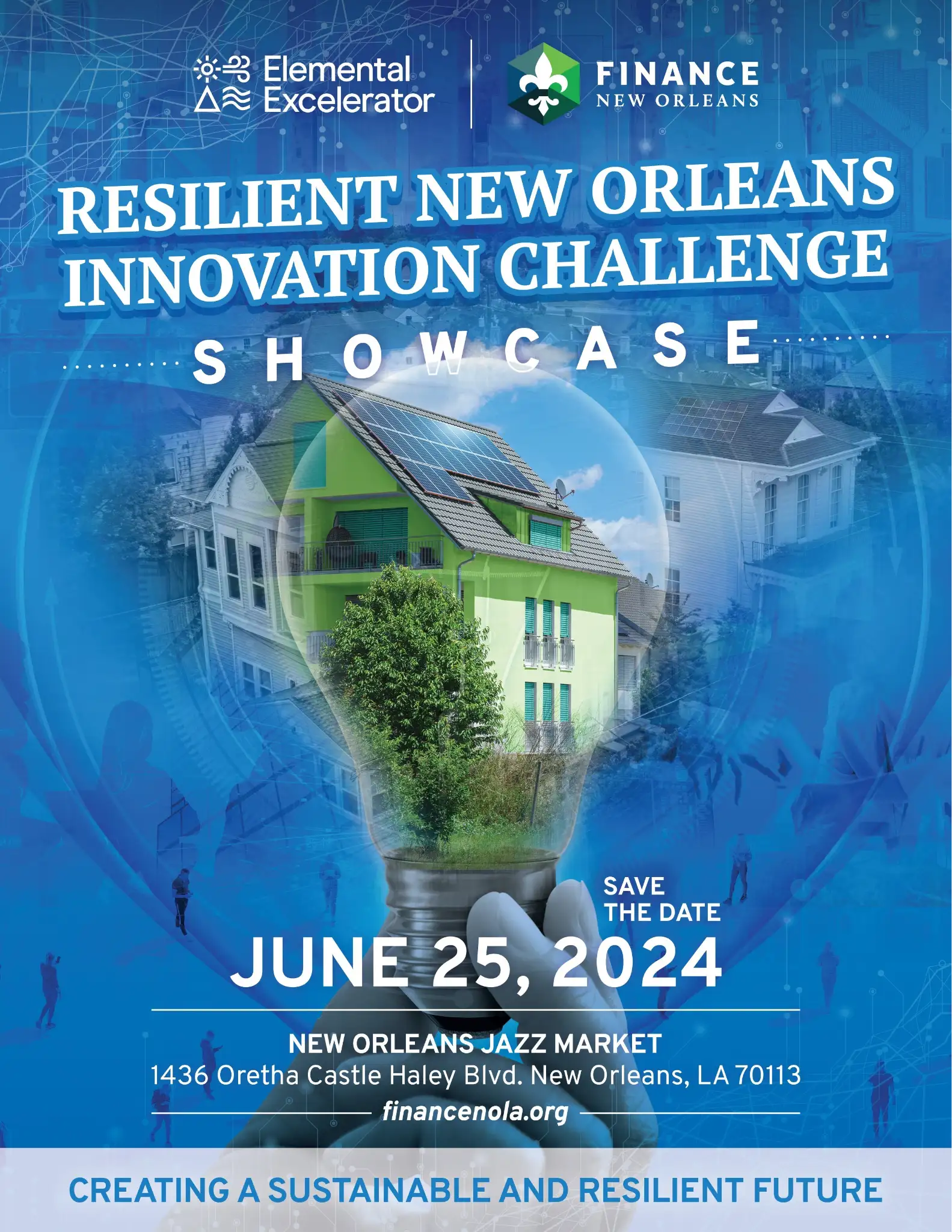

You are invited to the Resilient New Orleans Innovation Challenge Showcase sponsored by Elemental Excelerator in New Orleans, LA on Tuesday, June 25. The one-day event will highlight New Orleans’ public sector investment into sustainable housing and infrastructure as designed in the Resilience New Orleans Finance Plan. Climate technology companies competing to have their products deployed in public sector projects will be featured throughout the day. With help from Elemental Excelerator, we have identified over 34 climate technology companies across the world through our Resilient New Orleans Innovation Challenge. Between three to six of these climate technology companies will be selected to participate in a pilot homebuilding project sponsored by Finance New Orleans and other partners.

The Resilient New Orleans Innovation Challenge Showcase is intended to engage Finance New Orleans’ network of stakeholders, which includes city agencies, community organizations, developers, realtors, bond investors, commercial banks, foundations, green finance authorities, large corporations, climate technology companies and venture capital investors. Each of these groups are critical to Finance New Orleans reaching its goal of $1 billion of sustainable community investment in New Orleans by 2035. The day will be filled with innovative ideas and conversations around solutions to help us evolve as a community. We want a physically transformed New Orleans with equitable economic opportunities for all.

Please register here and visit this page to reserve your hotel room using the special conference rate at the Virgin Hotel. A limited number of rooms are available so please act quickly. A full agenda with logistics and other details will be shared soon. We hope to see you on June 25!

Washington, DC— The Coalition for Green Capital (CGC) and Dream.Org’s Green For All today announced a transformative partnership aimed at driving clean energy investments to communities that have been neglected and disproportionately impacted by the climate crisis and extreme weather events.

Green For All is a program of Dream.Org. The organization works to ensure that, as the green economy grows, all communities will benefit from good jobs, better health, and increased opportunity.

With a shared vision for environmental justice, Green For All joins a growing coalition preparing to seek funding from the Environmental Protection Agency’s (EPA) Greenhouse Gas Reduction Fund (GGRF) to establish a nationwide green bank network. This network will serve as a powerful tool to channel resources and financing to clean energy projects in low-income and disadvantaged communities (LIDCs).

“We’re thrilled to welcome Dream.Org to our growing coalition. Their expertise and commitment to environmental justice will help us maximize the impact of this once-in-a-lifetime investment of the Greenhouse Gas Reduction Fund,” said Reed Hundt, chairman of the board and CEO of CGC. “Together, we are poised to tackle the pressing climate crisis head-on and accelerate the Administration’s ambitious vision of transitioning to a clean energy economy. What truly sets this collaboration apart is our shared dedication to uplifting low-income and disadvantaged communities, ensuring they lead the way in reaping the rewards of this transformative energy future.”

Washington, DC— The Coalition for Green Capital (CGC) today announced the formation of a new strategic partnership with marketplace merchant Enervee. Enervee joins the growing coalition of clean energy lending experts preparing to seek funding from the Environmental Protection Agency’s (EPA) Greenhouse Gas Reduction Fund (GGRF) to launch a nationwide green bank network.

The EPA has made clear that the primary objectives of the GGRF are to reduce greenhouse gas emissions, drive funds and projects in low-income and disadvantaged communities, and mobilize financing and private capital to stimulate additional deployment of resources.

Enervee’s Eco Financing program is exactly the type of direct investment envisioned by the EPA for the $14B National Clean Investment Fund. The nationwide program leverages private capital, extends affordable financing to people with low credit scores, empowers income-constrained households to pay for efficient appliances with low monthly payments, reduces greenhouse gas emissions, and alleviates the burden of high utility bills.

“Adding Enervee as a strategic partner will greatly enhance the Coalition’s ability to serve millions of low and moderate-income households,” said Eli Hopson, executive director and COO of Coalition for Green Capital. “Our network of green lenders has already identified over $14B in clean energy project pipeline over the next several years, facilitating public-private partnerships to deliver relief in communities facing the brunt of the climate crisis. We look forward to demonstrating to the EPA why this nationwide network is the strongest tool for leveraging the IRA’s once-in-a-lifetime investment of federal funds.”

“Eco Financing has enjoyed the support of green banks in California and New York, but not every state has a green bank. The nationwide green bank network will allow us to serve all income- and credit-constrained consumers across the country and rapidly scale impact,” said Matthias Kurwig, Enervee’s CEO. “Eco Financing fills a critical gap in programs designed to drive decarbonization equitably, with over 85% of loans going to underserved borrowers.”

Washington, DC— The Coalition for Green Capital (CGC) and Spruce Root, Inc. today announced the formation of a new strategic partnership to unlock billions of public-private capital and deliver clean energy projects to local Alaska communities. This is the latest partnership announcement from CGC and comes as its growing, nationwide network of clean energy investors and lenders prepares to apply for federal funds from the Environmental Protection Agency (EPA) Greenhouse Gas Reduction Fund (GGRF) to launch a nationwide green bank.

“Spruce Root has been making a major difference for Southeast communities since its founding, which is why I am in strong support of this partnership with CGC,” said Representative Mary Peltola (AK). “This partnership will support the delivery of green infrastructure that is responsive to local needs. The combination of a national green bank organization and a regional community development group like Spruce Root provides an excellent blueprint for how to deploy clean energy funding efficiently and responsibly.

“Alaska is on the front lines of climate change, and our Indigenous communities have often borne the brunt of its impacts,”said Representative Peltola. “More needs to be done to provide for these communities, but partnerships like this are an important step in building resilience and capacity at the local level as we transition to a clean energy grid. I look forward to supporting more partnerships in this model, and maximizing the impact of the funding Congress has set aside for clean energy development.”

Spruce Root, Inc. is a non-profit community development financial institution delivering programs to communities and small businesses as they work to drive towards a regenerative economy in Southeast Alaska. They provide small business lending, technical and educational resources, and coaching programs, centered around Indigenous knowledge and values of land and resource stewardship.

Partnerships Formed With Finance New Orleans and Hawaii Green Infrastructure Authority

Washington, DC— The Coalition for Green Capital (CGC) today announced the formation of new strategic partnerships with clean energy community lenders, Finance New Orleans and the Hawaii Green Infrastructure Authority (HGIA). The announcement comes as CGC prepares to seek funding from the Environmental Protection Agency’s Greenhouse Gas Reduction Fund to launch a national green bank. These partners will join CGC’s application to the EPA.

“We’re excited to partner with Finance New Orleans and the Hawaii Green Infrastructure Authority, which together are ready to deliver on a pipeline of projects valued at nearly $4B in public-private funding,” said Eli Hopson, executive director and COO of CGC. “These entities know their local communities and will help ensure the national green bank delivers immediately – especially in underserved communities.”

“This partnership will allow us to collaborate with green lenders across the country, share best practices and ultimately maximize the investment of the Greenhouse Gas Reduction Fund,” said Damon Burns, president and CEO of Finance New Orleans. “Our region has a rich history of resilience and innovation, and it’s exciting to see this nationwide commitment to clean energy for frontline communities. We are proud to be a part of this effort and look forward to the positive impact it will have on underrepresented communities in New Orleans and beyond.”

“This new partnership with CGC and the national green bank is an opportunity to accelerate our transition to the clean power platform and make much-needed investments in frontline communities that have long faced the harshest consequences of the climate crisis,” said Gwen Yamamoto Lau, executive director of the HGIA. “The investment and support of this coalition will help drive the clean energy revolution, bringing us closer to a future powered by renewable sources and reducing our dependence on fossil fuels. We look forward to bringing accessible clean energy to lower the energy burden for our most vulnerable ratepayers.”

CGC recently announced similar partnerships with the Clean Energy Fund of Texas, Growth Opportunity Partners, Inc., and the Community Development Venture Capital Alliance (CDVCA). The new partnerships build upon CGC’s nationwide coalition of over 30 green banks and other lenders focused on addressing the climate crisis by financing clean energy projects in local communities.

Finance New Orleans is a green finance agency with a vision of creating a resilient New Orleans for all. Since 1978, Finance New Orleans has invested more than $750 million into the local economy. Those efforts have been primarily focused on homeownership for low-to-moderate-income families and have resulted in more than 8,000 mortgage financings and the creation of affordable rental units for families in need. In 2017, Finance New Orleans also became the City’s green bank to drive more investment into sustainable infrastructure alongside needed green housing investments.

The Hawaii Green Infrastructure Authority is a state authority in Hawaii, responsible for the development and financing of green infrastructure projects that reduce emissions and support underserved communities in the state. 100% of HGIA funding benefits underserved ratepayers defined as low and moderate-income homeowners, renters, small businesses (as defined by the U.S. Small Business Administration’s Size Standards), nonprofits, and multi-family rental projects.

Reach out to your members of Congress and share your support of the Clean Energy & Sustainability Accelerator

S.283, introduced by Senators Markey and Van Hollen, and H.R.806, introduced by Congresswoman Dingell, will provide the investment needed to accelerate America’s transition to clean energy with equity and justice in mind.

Visit the link below to fill out your information to securely email your members of Congress in support the Clean Energy & Sustainability Accelerator, a national climate bank.

FOR IMMEDIATE RELEASE

March 31, 2021

press@coalitionforgreencapital.com

President’s American Jobs Plan Turns to Green Bank Model to Accelerate Clean Energy Deployment, Job Creation

Proposal has gained GOP support from Rep. Don Young and Rep. Brian Fitzpatrick

WASHINGTON—The White House’s American Jobs Plan includes $27 billion for a Clean Energy & Sustainability Accelerator, based on the proven green bank model, to mobilize private investment into distributed energy resources; retrofits of residential, commercial and municipal buildings; and clean transportation. The bank would make at least 40 percent of its investments in disadvantaged communities that have not yet benefited from clean energy investments.

“I congratulate President Biden, the whole White House team, and lead Congressional champions Senators Markey and Van Hollen and Congresswoman Dingell on the decision to create what would be the first national climate bank. The Clean Energy & Sustainability Accelerator will expand in scale and scope the way more than a dozen state and local green banks that for the last decade have combined public and private capital to expedite the transition from carbon to clean power as the platform for American society and business. We at the Coalition for Green Capital look forward to discussing with legislators the actual activities of the Accelerator as the brilliant infrastructure plan makes its way through Congress," said CGC CEO Reed Hundt.

The nonprofit Clean Energy & Sustainability Accelerator was included in the U.S. House Energy & Commerce Committee’s comprehensive CLEAN Future Act.

Since Sen. Chris Van Hollen (D-Md.), Sen. Ed Markey (D-Mass.), Sen. Richard Blumenthal (D-Conn.), Sen. Brian Schatz (D-Hawaii) and Congresswoman Debbie Dingell (D-Mich.) introduced S. 283 and H.R. 806, they have gained Republican support in the House from Rep. Brian Fitzpatrick (R-Pa.) and Rep. Don Young (R-Alaska). Sen. Debbie Stabenow (D-Mich.) has also added her support since introduction.

The National Academies of Science has recommended that Congress fund an institution based on the green bank model. In its report, it wrote, “Private sources of capital are unlikely to be sufficient to finance the low-carbon economic transition, especially during the 2020s when the effort is new. To ensure industrial competitiveness and quality of life, the United States should establish a Green Bank to mobilize finance for low-carbon infrastructure and business in America.”

In January, two independent reports by the Analysis Group and The Brattle Group found that a national Clean Energy Accelerator would have an outsized impact helping the United States recover from the economic effects of the COVID-19 pandemic and also speed up the country’s deep decarbonization and Environmental, Social and Corporate Governance (ESG) efforts.

Green banks currently exist in over 14 cities and states across the country and have supported over $5 billion in investment in clean energy projects in their states and local communities, and much of this investment has been targeted toward low- and moderate-income households and communities. View a list of projects that have been supported by already existing state and local green banks.

FANO Launches Developer Webinar Series Amid CEA Partnership with the City and Louisiana Housing Corporation

NEW ORLEANS, La. – The Finance Authority of New Orleans (FANO) has announced its partnership with the Louisiana Housing Corporation (LHC) to provide more affordable housing in the City of New Orleans. The Cooperative Endeavor Agreement (CEA) between the City, FANO and LHC is designed to build public agency coordination that will increase affordable housing development in New Orleans.

“Affordable housing has always been a top priority of this administration. This need is even more critical as residents face additional challenges due to the COVID-19 pandemic, “ said Mayor LaToya Cantrell. The CEA will allow FANO to offer affordable financial products including tax-exempt bonds, property tax exemptions and green infrastructure loans to developers building affordable, climate resilient housing.

As part of FANO’s climate resilient financing program roll-out, the agency has planned a series of monthly virtual workshops for area developers and contractors to discuss topics related to sustainable building. “The Developer Webinar Series is an opportunity for beginner and experienced developers to learn about FANO’s affordable housing products with an end goal of stimulating affordable housing production and job creation,” said Damon Burns, FANO CEO and President. “Mayor Cantrell and the City Council have instructed FANO to increase economic opportunity by prioritizing beginning developers and contractors. Coordination with LHC will allow us to move webinar attendees from class to the closing table. Each public partner understands the urgency and has committed investments to solve our affordable housing crisis,” Burns said.

“I am proud to partner with the Finance Authority of New Orleans and the Louisiana Housing Corporation to ensure improved public agency coordination to help make this happen. Together we are working to meet people where they are, using webinars to educate developers on how to create more housing and more jobs,” said Mayor Cantrell.

FANO’s Developer Webinar Series will provide developers and builders with key information pertaining to the benefits of partnering with its agency to create more opportunities for affordable, climate resilient housing and commercial space throughout New Orleans. FANO’s first Developer Webinar Series Workshop will include Marjorianna Willman, the City’s Director of Housing Policy & Community Development and LHC Executive Director E. Keith Cunningham, Jr., as presenters. Burns, Willman and Cunningham will discuss their new CEA partnership to fund sustainable, affordable multi-family housing and green infostructure.

“Mayor Cantrell has a vision of the City working across lines, partnering with LHC and FANO to provide affordable and sustainable housing throughout the City. In the COVID-19 world it is not just a goal but a must,” said Willman. “One of the Louisiana Housing Corporation’s greatest tools for increasing housing sustainability in Louisiana is our 4 percent Low-Income Housing Tax Credits,” said Cunningham. “Our partnership with FANO leverage’s that tool with new and existing partnerships to address the needs of New Orleans’ communities and developers. In this way, we ensure our commitment to provide affordable, resilient housing to New Orleanians, while at the same time, creating economic opportunities that are beneficial to everyone involved,” Cunningham said.

The Developer Webinar Series begins Friday, July 31st, and will continue indefinitely. Each month FANO will present experts in the developer field to discuss topics such as green financing & building standards, taxes & bonds, and more. All workshops will commence at 11am and will be geared to both larger-scale and smaller developers, and related local businesses. To attend FANO’s Developer Webinar Series Workshops, RSVP via Eventbrite. The Developer Webinars will also be available on FANO’s YouTube channel. For additional information about FANO’s Developer Webinar Series, email inquiries to RSVP.FANO@gmail.com.

Finance Authority of New Orleans partners with Louisiana Housing Corporation

and City of New Orleans to provide more Affordable Housing

NEW ORLEANS, La. – Finance Authority of New Orleans (FANO) has announced its partnership with the Louisiana Housing Corporation (LHC) to provide more affordable housing in the City of New Orleans. The Cooperative Endeavor Agreement (CEA) between the City, FANO and LHC is designed to build public agency coordination that will increase affordable housing development in New Orleans.

“Cooperation among government agencies is needed to address the large amount of demand for affordable and climate resilient housing,” said Damon Burns, FANO CEO and President. “This agreement is an example of the type of collaboration required to deliver more value to the community,” Burns said.

The CEA will allow FANO to offer affordable financial products including tax-exempt bonds, PILOTs and green infrastructure loans to developers building affordable, and climate resilient housing.

“This is a unique partnership between the State and municipal entities,” said LHC Executive Director E. Keith Cunningham, Jr. “Housing is a local concern, and having local partners ensures that we get it right. This endeavor gives us the ability to make an even greater impact within the City of New Orleans,” said Cunningham. The program will officially launch in June 2020.

For over 40 years, FANO has been committed to making homeownership possible for families in New Orleans. FANO recently updated its mission in response to the need for more environmentally sustainable housing and infostructure in Orleans Parish. For more information about The Finance Authority of New Orleans, please call (504) 524-5533 or visit financeauthority.org.

Community Support Fund Created for Rental and Utility Assistance During COVID-19

The Finance Authority of New Orleans provides flexible resources to qualified families in Orleans Parish

NEW ORLEANS, La.—The Finance Authority of New Orleans (FANO) has announced the establishment of their Community Support Fund (CSF) in response to the Coronavirus (COVID-19). These funds will help Orleans Parish residents who qualify with rent or utility assistance in the wake of the pandemic.

Funds will be awarded to potential homebuyers and existing homeowners who qualify as part of the vulnerable populations disproportionately affected by COVID-19. The CSF is designed to complement FANO’s other community assistance programs and resources. In addition to providing rent and utility assistance, the CSF will also develop a transition plan for each potential homebuyer to ensure they are prepared for a post-COVID-19 environment.

“This is an extremely difficult time for all New Orleanians, especially for those who have lost loved ones, income, or have experienced other hardships that prevent their ability to maintain a stable home,” said Damon Burns, FANO’s President and CEO. “Our mission with this Fund, and with our other programs, is to provide financial products that improve the quality of life in New Orleans, with a focus on affordable housing, job creation and environmental protection,” Burns said.

The CSF primarily focuses on potential homebuyers and homeowners within Orleans Parish who have suffered a substantial loss of income due to the COVID-19 pandemic. Qualifications include, but are not limited to the following: reduction in job compensation, an obligation to be absent from work to care for home-bound school-aged child(ren), or job loss. Funding will be pooled into two categories for disbursement:

Category 1

- Rental assistance with a maximum benefit amount of $500 per household

Category 2

- Utility assistance with a maximum benefit amount of $75 per household

To apply for FANO’s CSF assistance, residents should call (504) 524-5533, (504) 354-0904, or email: csf@financeauthority.org. Applicants will be pre-screened to determine basic eligibility and will receive notice of the documentation needed to qualify for the program.

For over 40 years, FANO has been committed to making homeownership possible for families in New Orleans. FANO recently updated its mission in response to the need for more environmentally sustainable housing and infostructure in Orleans Parish. For more information about The Finance Authority of New Orleans, please call (504) 524-5533 or visit financeauthority.org.

BAMM Communications is a public relations agency for The Finance Authority of New Orleans. For more information about BAMM, visit www.BAMMComunications.com

FANO Changes Its Business Model To Address Climate Change

The Finance Authority of New Orleans relocates and shifts its focus to the City of New Orleans’ resiliency efforts

NEW ORLEANS, La.— Finance Authority of New Orleans (FANO) has relocated its office to the Place St. Charles building at 201 St. Charles Avenue, Suite 4444, in New Orleans. With this new location, FANO is housed in the heart of downtown New Orleans’ financial district, within one-‐half block of branches of the three largest banking institutions in Louisiana.

This relocation is happening on the heels of FANO’s transition to a new business model that focuses on resiliency efforts in the community. The model presents a strategic plan that will finance the deployment of energy efficiency, storm water management, and green infrastructure projects for homeowners, businesses and local governments.

“We’re extremely excited about our new business model,” said Damon Burns, FANO’s president and CEO. “One facet of FANO’s new model offers homeowners Green mortgages that assist with funding to help protect their homes from inclement weather and potential natural disasters,” Burns said.

FANO is supporting the City of New Orleans’ climate resilience goals to embrace environmental change, create new job opportunities for distressed communities and physically transform the city to better handle natural disasters. In the current climate, FANO sees the opportunity to make the city more financially resilient, as well as develop a sound infrastructure for generations to come.

“Because New Orleans and the surrounding areas face climate challenges, unlike any city in the U.S., and with sea levels potentially rising over 10 feet within the next 100 years, the City of New Orleans is being proactive ensuring a functional New Orleans for future generations, and FANO is happy to do our part to support the City’s efforts,” Burns said.

For over 40 years, FANO has been committed to making homeownership possible for more families in New Orleans; and FANO will continue to build on that mission by evolving its efforts to make New Orleans a more sustainable city. For more information about the Finance Authority of New Orleans, please contact us at (504) 524-5533 or visit financeauthority.org.

Over the past year, the Finance Authority of New Orleans, board and staff under the leadership of our Executive Director Damon Burns, has worked conscientiously to REBRAND, REVITALIZE and REINVENTitself in 2017. The work has been consistent and at times difficult and has taken the dedication of the entire team in bringing forth the following highlights and accomplishments:

REBRANDING – FANO has launched a successful rebranding campaign that has included a new logo, bold new colors an updated mission to improve the quality of life in the city of New Orleans by directly investing in the creation of affordable housing and economic development projects that produce quality jobs and wealth for residents. The rebranding campaign included a launch at the New Orleans Jazz Market that drew New Orleans citizens, City leaders, realtors, lenders, developers and many of our partners in the housing arena.

REVITALIZATION – FANO has revitalized its Partnerships with the City of New Orleans, Housing Authority of New Orleans (HANO), New Orleans Redevelopment Authority (NORA), and a number of diverse organizations, neighborhoods and agencies across the city including, The Greater New Orleans Housing Alliance (GNHOA), Neighborhood Housing Services (NHS), Neighborhood Development Foundation (NDF) and many others.

REINVENTION – In 2017 FANO has reinvented its signature homebuyer program, rebranded, “Own New Orleans”, that allows homebuyers to acquire downpayment assistance on 1 or 2 unit, single family homes. We are also developing new initiatives with our partners and the City’s Office of Resilience, while we continue to reinvent our longstanding programs to ensure that our mission is fully realized.

Moody’s Investors Service has upgraded the ratings of the New Orleans Finance Authority, LA Qualified Mortgage Revenue Bonds 2006A to Aaa from A2. Approximately $4.1 million in debt is affected.

RATINGS RATIONALE

The upgrade to Aaa is based on the upgrade of the Guaranteed Investment Contract (“GIC”) Provider Bayersiche Landesbank to A1/P-1 Stable. The A1/P-1 rating on the counterparty can support up to a Aaa on the bond program.