Learn about Finance New Orleans including our News & Press Releases and Programs.

Talk to us

Have questions? Reach out to us directly.

Learn about Finance New Orleans including our News & Press Releases and Programs.

About Finance New Orleans

- Founded

- 1978

- Total Mortgage Amount since 2015

- $10,901,610

- Average Assistance Amount

- $5,330

Finance New Orleans (FNO) is a housing and development finance agency serving all New Orleanians to better our community. We provide mortgage financing for low-to-moderate income families and credit support for affordable rental and community development projects.

Founded by the City Council of New Orleans in 1978 as the “New Orleans Home Mortgage Authority,” our organization began by recognizing and acting on the demand for more affordable home mortgage financing. Today, FNO operates with a seven-member Board of Trustees appointed by the City Council of New Orleans, however we are not a department or division of the city government.

Since 1979, FNO has invested more than $650 million into the New Orleans economy. Our efforts have been largely focused on homeownership for low-to-moderate income families. These investments have resulted in more than 8,000 mortgage financings and the creation of affordable rental units for families in need.

Our goal for the future is to continue investing in homeownership because we believe it is the foundation of a functional community. In addition to homeownership, we are increasing our investments in multifamily and economic development projects that create stability in our neighborhoods.

Image Gallery

News

The Walton Family Foundation has awarded $775,000 to a strategic partnership between Quantified Ventures (QV) and PRE Collective (PRE) to accelerate investments in nature-based climate and water solutions in the Colorado River and Mississippi River Basins.

The partnership will provide grants and technical assistance to three Green Banks – the Illinois Finance Authority, Finance New Orleans, and the Colorado Clean Energy Fund – to build a pipeline of scalable nature-based projects with measurable greenhouse gas reduction benefits, including sustainable agriculture, green stormwater infrastructure, and watershed restoration.

This award follows the efforts of the U.S. Environmental Protection Agency’s Greenhouse Gas Reduction Fund (GGRF) to capitalize green banks across the country, representing a once-in-a generation opportunity to shift financing interest toward nature-based climate mitigation efforts. In April 2024, the Robert Wood Johnson Foundation committed $1.3 million to support QV, PRE, and partners in similar work in different regions of the United States.

Financing and funding for environmental infrastructure and nature-based climate solutions is critical at this juncture. A recent Request for Information from QV resulted in 120+ projects in the pipeline across the country, with nearly $4.5 Billion in project financing needed.

Partner Quotes:

Tee Thomas, CEO, Quantified Ventures: “Green Banks are force multipliers for solutions at the intersection of climate, nature, and community resilience. Thanks to the Walton Family Foundation, this funding and technical assistance will better equip three leading Green Banks to identify, evaluate, catalyze, and scale impactful nature-based projects across two critical Watersheds.”

Shalini Vajjhala, Executive Director, PRE Collective: “Nature-based infrastructure projects are both the most exciting and challenging projects to design and finance. The Walton Family Foundation’s investment in early-stage predevelopment with Green Banks is a transformational opportunity to demonstrate how multi-benefit, community-centered, landscape-scale solutions can be part of a comprehensive portfolio of climate investments.”

Chris Meister, Executive Director, Illinois Finance Authority: “The Illinois Finance Authority/Climate Bank is grateful to the Walton Family Foundation for its inclusion of Green Banks in this strategic effort. Building on a record of past climate finance innovation, the Authority looks forward to partnering with Qualified Ventures and PRE Collective to build new financial products for nature-based infrastructure projects. Nature-based solutions offer innovative and impactful ways to address climate challenges outside of traditional renewable energy products.”

Annie Clark, Chief Programs Officer, Finance New Orleans: “We are grateful to be a recipient of the Walton Family Foundation’s investment in nature-based solutions. This funding is a significant step forward in our mission to build resilient communities through sustainable investments. By focusing on nature-based solutions, we are not only addressing the immediate impacts of climate change but also laying the groundwork for long-term environmental and economic benefits. The support from the Walton Family Foundation will empower us to expand our efforts in New Orleans, and we are committed to driving measurable change that will benefit future generations.”

Paul Scharfenberger, CEO, Colorado Clean Energy Fund: “Walton Family Foundation’s investment and support, combined with technical assistance from QV and PRE, will enable CCEF and other Green Banks to expand our investment focus areas and capacity to include nature-based projects that are critical to combating climate change. CCEF is grateful for the partnership, and we value the innovative thinking of all the organizations involved.”

Morgan Snyder, Senior Program Officer, Walton Family Foundation: “We must make more low cost financing available, like those in the GGRF, to scale natural climate solutions to adapt to the impacts of climate change on our water systems. We are proud to partner with QV and PRE to lead this effort.”

About PRE Collective

PRE Collective is a group of public-service minded infrastructure and project development experts helping communities and regions make the most of transformational infrastructure opportunities. We focus on pre development – the early, messy space where infrastructure gaps, needs, priorities, and potential solutions are framed. Our goal is to build collective momentum for equitable implementation of climate mitigation and adaptation solutions.

About Quantified Ventures

Quantified Ventures (QV) is a nationally recognized leader in implementing innovative funding and financing strategies for climate, environmental, health, and human services projects. Our success stems from quantifying project outcomes, identifying untapped financial resources, and structuring innovative partnerships that engage new capital providers and stakeholders. QV is a certified B Corporation and WBENC women-owned business that has worked extensively to provide technical assistance for establishing and administering water, energy, and climate financing programs.

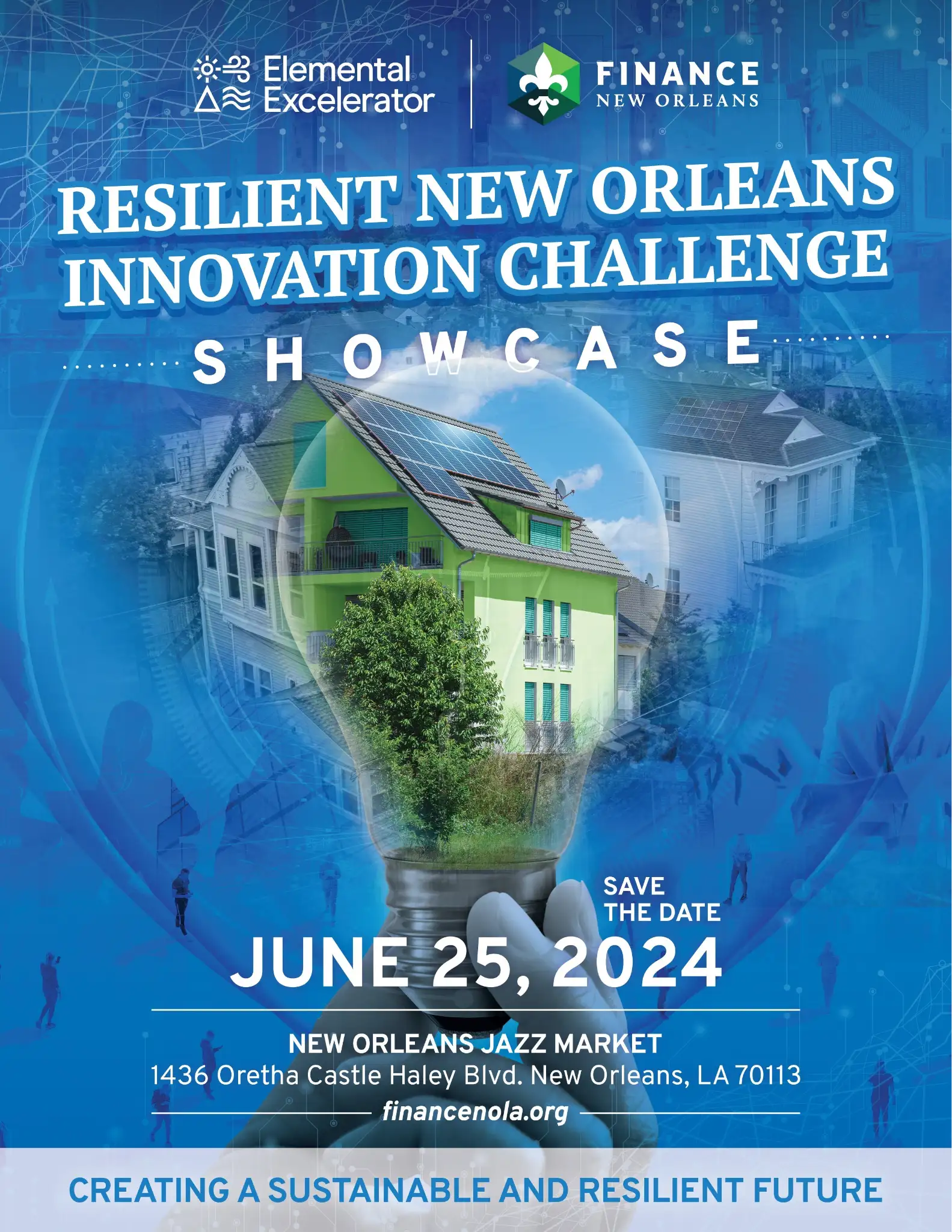

You are invited to the Resilient New Orleans Innovation Challenge Showcase sponsored by Elemental Excelerator in New Orleans, LA on Tuesday, June 25. The one-day event will highlight New Orleans’ public sector investment into sustainable housing and infrastructure as designed in the Resilience New Orleans Finance Plan. Climate technology companies competing to have their products deployed in public sector projects will be featured throughout the day. With help from Elemental Excelerator, we have identified over 34 climate technology companies across the world through our Resilient New Orleans Innovation Challenge. Between three to six of these climate technology companies will be selected to participate in a pilot homebuilding project sponsored by Finance New Orleans and other partners.

The Resilient New Orleans Innovation Challenge Showcase is intended to engage Finance New Orleans’ network of stakeholders, which includes city agencies, community organizations, developers, realtors, bond investors, commercial banks, foundations, green finance authorities, large corporations, climate technology companies and venture capital investors. Each of these groups are critical to Finance New Orleans reaching its goal of $1 billion of sustainable community investment in New Orleans by 2035. The day will be filled with innovative ideas and conversations around solutions to help us evolve as a community. We want a physically transformed New Orleans with equitable economic opportunities for all.

Please register here and visit this page to reserve your hotel room using the special conference rate at the Virgin Hotel. A limited number of rooms are available so please act quickly. A full agenda with logistics and other details will be shared soon. We hope to see you on June 25!

Washington, DC— The Coalition for Green Capital (CGC) and Dream.Org’s Green For All today announced a transformative partnership aimed at driving clean energy investments to communities that have been neglected and disproportionately impacted by the climate crisis and extreme weather events.

Green For All is a program of Dream.Org. The organization works to ensure that, as the green economy grows, all communities will benefit from good jobs, better health, and increased opportunity.

With a shared vision for environmental justice, Green For All joins a growing coalition preparing to seek funding from the Environmental Protection Agency’s (EPA) Greenhouse Gas Reduction Fund (GGRF) to establish a nationwide green bank network. This network will serve as a powerful tool to channel resources and financing to clean energy projects in low-income and disadvantaged communities (LIDCs).

“We’re thrilled to welcome Dream.Org to our growing coalition. Their expertise and commitment to environmental justice will help us maximize the impact of this once-in-a-lifetime investment of the Greenhouse Gas Reduction Fund,” said Reed Hundt, chairman of the board and CEO of CGC. “Together, we are poised to tackle the pressing climate crisis head-on and accelerate the Administration’s ambitious vision of transitioning to a clean energy economy. What truly sets this collaboration apart is our shared dedication to uplifting low-income and disadvantaged communities, ensuring they lead the way in reaping the rewards of this transformative energy future.”

Programs

Talk to us

Have questions? Reach out to us directly.